what is fsa health care contribution

Typically the contribution limit is 5000 for married couples filing jointly and 2500 for single filers. As a result the IRS just recently announced the revised contribution limits for 2022.

Hsa And Fsa Accounts What You Need To Know Readers Com

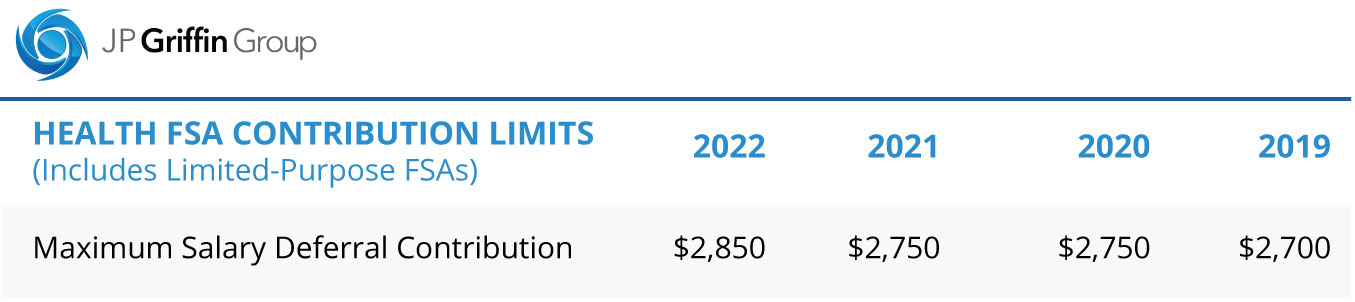

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850.

. Flexible spending account FSA Annual contribution limits and adjustments. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. If employers provide.

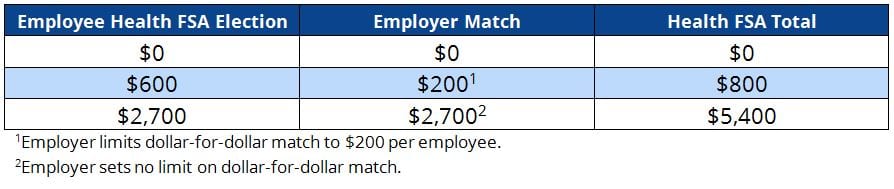

Employer Health FSA Contributions. HSA maximum family 7300. Maxing out your contributions is only a good.

The IRS limits how much can be contributed to an FSA account per year. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. You can contribute up to 2750 in 2021 and 2850 in 2022 into your Healthcare FSA.

For example if you earn 45000 per year and allocate 2500 to your FSA for health care expenses. For example if your employer put in 300 and you decided to contribute 600 you have 900 to spend right away. For 2021 single and married filers can contribute up.

In 2022 the limit is 2750 per year per employer. You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. You decide how much to put in an FSA up to a limit set by your employer.

You may enroll in an FSA for 2022 during the current Benefits Open Season which runs through December 13 2021 midnight EST. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. Find your comfort zone.

If you have any questions about your plans limits contact your employer or financial institution. When you have a health or limited-purpose FSA the total amount is available on the first day. Basic Healthcare FSA Rules.

You also learn how much you could save on taxes. This is because the health FSA 2600 salary reduction contribution limit is merely a plan year maximum. HSA maximum individual 3650.

For 2019 employees with self-only HDHP coverage can contribute up to 3500 and employees with family HDHP coverage can contribute up to 7000. These tools make it easy to check your medical records. The legislation increased the 2021 contribution limits for the dependent care FSA only.

FSAs only have one limit for individual. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. 10 as the annual contribution limit rises to 2850 up from.

Employees can therefore make full 2600 elections to multiple health FSA plans in the same year. While the IRS 2021 pretax maximum for employee health FSA contributions is 2750 an employer may limit its employees to less than 2750. Note that this is different from the dependent care FSA which imposes an individual calendar year maximum.

Its a smart simple way to save money while keeping you and your family healthy and protected. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. However COVID-19 relief legislation permitted carryover of unused DCFSA balances into the next plan year for plan years 2020 and 2021.

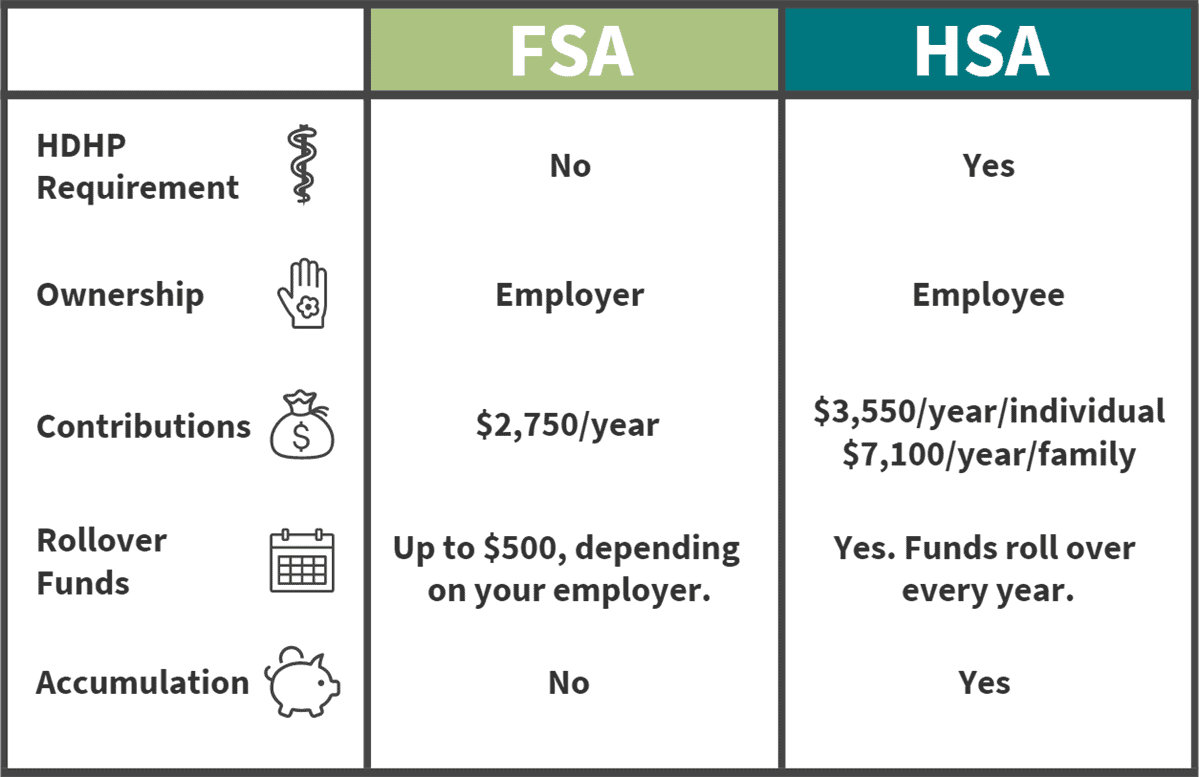

The contribution limits on dependent care FSAs are also higher. You contribute funds to an HSA and FSA but only your employer can contribute to your HRA. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

For medical expense FSA accounts the annual contribution limit per employee is 2750 for 2021 and 2850 for 2022. It remains at 5000 per household or 2500 if married filing separately. If you have a Health FSA also sometimes called a Medical FSA you can use it to pay for eligible out-of-pocket medical expenses with pre-tax dollars.

When you open a health FSA your employer puts an. If youre age 55 or older you can contribute up to an additional 1000. Employers may make contributions to your FSA but.

You dont pay taxes on this money. Once you have your total compare it to the maximum amount the IRS lets you put into an FSA. Second your employers contributions wont count toward your annual FSA contribution limits.

There are a few things to remember when it comes to establishing and then spending from your Healthcare FSA. Here are the maximum contribution amounts for 2022. Its not an individual maximum.

In general an FSA carryover only applies to health care FSAs. Youd pay back the 600 over the year. When you have a dependent care FSA you can only access your account balance.

The minimum annual election for each FSA remains unchanged at 100. You can contribute up to 2850 in 2022 but you can adjust your amount only during open enrollment or if you have a qualifying event such as getting married or having a. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

Ask your employer if you have a digital health management app such as Wellframe as a benefit. An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. FSA maximum 2750 or lower depending on employer.

For plan year 2022 the maximum contribution amount that employees can make to their DCFSAs returns to 5000.

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

What Do I Need To Know About Fsas And Hsas One Medical

The Difference Between Hsas And Fsas Employee Benefits Ves

Hra Vs Fsa See The Benefits Of Each Wex Inc

Erika Seaborn M A On Instagram Hsa Vs Fsa Smart Money Health Plan Hsa

Health Care Fsa University Of Colorado

Do You Know What Fsa And Hsa Really Are Flexiblebenefits Tips Fsa Hsa Health Savings Account Flexibility Design Help

Can Employers Add To Employee Health Fsa Contribution Core Documents

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

What S The Difference Between An Fsa And An Hsa Aspen Wealth Management

Tax Saving Opportunity For Employees Accounting Services Tax Opportunity

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org Medical Saving Money Human Resources

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Fsa Contribution Limits 2021 Health Savings Account Personal Budget Personal Finance Advice

10 Things You Absolutely Need To Know About Employee Benefits Employee Benefit Health Insurance Companies Health Care Insurance